R and D Tax Credits

What are Research and Development Tax Credits?

R&D Tax Credits or R&D Tax Relief as it is also known, is a government incentive scheme:

1) Small to Medium-sized Entity (SME) Scheme

2) Research and Development Expenditure Credits (RDEC)

If your company carries out research and development, you may be eligible for tax incentives through one or both of these schemes. Limited companies spending money trying to develop a new process, material, device, product or service, or making significant improvement to existing ones, may be entitled to claim.

FIND OUT IF YOU'RE ELIGIBLEThere are Three Qualifying Criteria

- You have to be a limited company.

- Your limited company has to be a going concern.

- You have to be undertaking a project that is trying to seek an advance in science or technology, through the resolution of scientific or technological uncertainty.

What costs qualify?

-

Staff Costs

-

Software

-

Consumed Materials

-

Consumed Utilities (Heat, Light, Water and Power)

-

Externally Provided Workers

-

Subcontracted R&D

-

Subjects of clinical trials

-

Contributions to Independent Research

-

Qualifying Indirect Activities

Book an Initial Consultation

An initial consultation to explore whether you may be eligible costs nothing.

The money you could be entitled to claim has the potential to transform your project, your cash flow and your company.

Research and Development Tax Credits FAQs

-

Does my business qualify for the SME or Large Company Scheme?

-

Am I eligible for Research & Development Tax Credit?

-

What is the Research & Development Expenditure Credit (RDEC)?

-

SME subcontracting – can I make a tax credit claim?

-

Research & Development Expenditure Credit

How We Help

At Cooden Tax Consulting we help limited companies that are advancing the state of their industry and investing in innovation to maximise the use of the tax incentives available. Your R&D Tax Relief claim can be received as a cash payment, reduce corporation tax, or increase taxable losses.

The average R&D tax credit claim for SMEs is around £55,000, but many eligible businesses are still failing to claim.

There are over 500 pages of guidance for putting in an R&D Tax Credits claim, but our team of experts specialise solely in Technology Tax Reliefs, including the Research & Development Tax Credit and the newly legislated creative industry reliefs.

R&D Case Studies

Dev Subatra - Founder, Fidel

Fidel Limited – Fintech Loyalty Rewards Technology – saved £50k+

This was a complex development project that involved an extensive and expensive collaboration with Visa and Mastercard to connect to their data feed. The API needed to be compliant with the PCI framework – the Payment Card Industry Data Security Standard.

Read the Full Case Study

Max Windheuser - Director, Evinox Energy Ltd

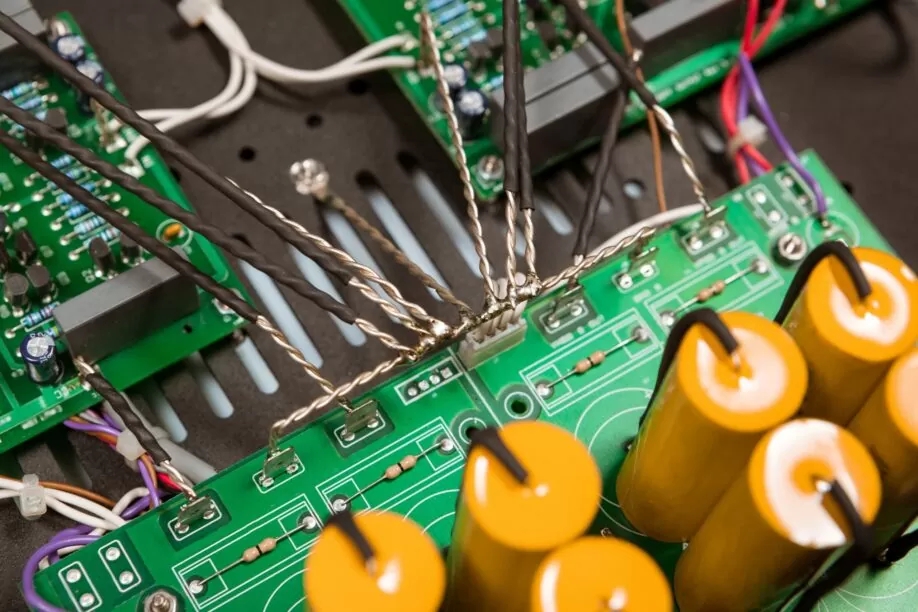

Evinox Energy Ltd – Heating Systems – Saved £140k+

There were several separate projects making up claims for R&D tax relief. One of these was the development of an improved heat interface unit. It was designed to be a combined boiler and tank, with connections to a wider system for heating multiple occupancy accommodation.

In its new design the company sought to improve the efficiency and unit cost of manufacture by introducing a new efficient pump, developing new (and less) control valves, as well as an intuitive ViewSmart Room Controller, that incorporated their own PaySmart pre-payment technology, to allow for centralised reporting and billing.

Read the Full Case Study

Ben Turney - CEO, Teathers

Teathers Financial Software Limited – Fintech Investment App – saved £79k

Teathers research and development work was based around innovative software development (Software as a Service – SaaS) and a new private investor experience concept.

The Teathers App is an execution-only platform. When an AIM-listed company raises money, “onboarded” users of the Teathers App have the opportunity to get involved.

Users are onboarded by downloading the iOS or Android app and completing an account application process. This sets up an execution-only brokerage account with Shard Capital.

Read the Full Case Study

Richard Moore - MD, The Source

The Source – Subterranean Skatepark – saved £26k

The skate park build was very complex and needed a great deal of scientifi c construction research before it could go ahead.

The site dates back to the 1800’s and had been derelict for approximately 18 years. It was originally a swimming pool that also had (and still does have) a full basement of water. The whole footprint of the building is part of a natural stream and water from the roads drain down into the space.

This creates a marine environment. Calculations were required for understanding how timber ramps would expand and contract with the humidity, for example.

Read the Full Case Study

Andy Johnson - Director, Cosmarida Limited

Cosmarida Limited – Cosmetics Manufacturer – Saved £49k

Cosmarida work in an industry where formulation development is an ongoing R&D process. The skincare and toiletries products are constantly being refreshed with new fragrances and

active ingredients.

Despite working to a “brief” from their customer for most product developments, the company were able to qualify for the SME tax relief scheme because the brief was vague. Cosmarida had to experiment with different combinations of fragrances and ingredients to produce a number of samples and make multiple changes to get customer approval. Even then the R&D work isn’t finished.

Scaling up from a small 100ml pot to a 1,000 litre test batch and then a 10,000 litre first production batch, still represent significant challenges. As well as the product manufacturing, the company has also designed and built machines for unique packaging requirements.

Read the Full Case Study