R&D Tax Relief Qualifying Costs

What Costs Qualify for R&D Tax Relief?

One of the most important aspects of successfully claiming R&D tax relief is establishing exactly what you spent on your research and development projects. This spending is known as ‘qualifying costs’ and it can be a major source of confusion for businesses of all sizes when they come to make their R&D tax credit claim.

At Cooden Tax Consulting, we have extensive experience helping companies understand which costs qualify and can be claimed against. This allows our clients to maximise their claims and get the tax relief that they are owed.

Here we have provided a guide to establishing your qualifying costs to make it easier for you – but if you are interested in working with a firm that specialises in R&D tax claims, please get in touch with us today.

FIND OUT IF YOU'RE ELIGIBLEQualifying Costs Explained

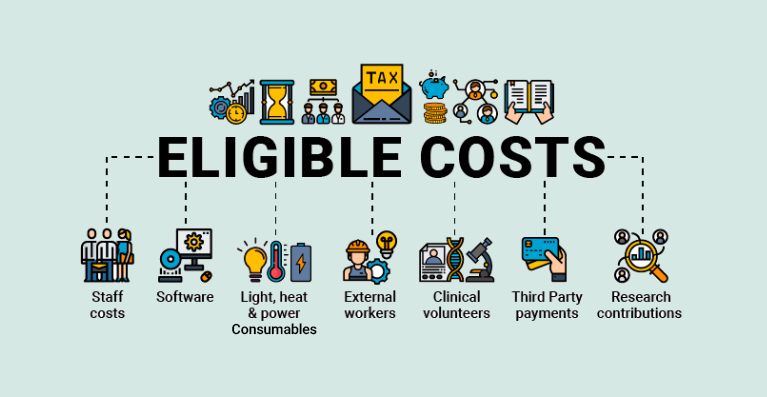

There are strict rules governing what business can claim tax relief against in their R&D projects. Typically, it is considered that revenue expenditure (such as staff costs) can be claimed against, while capital expenditure (such as buildings and other fixed assets) cannot.

-

Staff costs and salaries

-

Externally provided workers (EPWs)

-

Subcontracted R&D work

-

Software

-

Consumables

-

Subjects of clinical trials

-

Cloud Computing and Data Costs

What doesn’t count as a qualifying cost?

While there are some specific exceptions set down by HMRC, in general you cannot claim for the following:

- Capital expenditure

- The cost of land or hosting

- The cost of trademarking

- The production and distribution of goods and services

Work with specialists

Establishing exactly which costs can be claimed as part of your R&D tax relief claim is one of the most complex aspects of the procedure. Putting down costs that do not qualify can invalidate your claim and slow up the process of you getting the tax credits you are owed. On the other hand, if you don’t claim for everything, you can be missing out on tax relief that you deserve.

If you would like to work with a team of specialists in R&D tax credit claims, Cooden Tax Consulting would be happy to help you.

R&D Case Studies

Dev Subatra - Founder, Fidel

Fidel Limited – Fintech Loyalty Rewards Technology – saved £50k+

This was a complex development project that involved an extensive and expensive collaboration with Visa and Mastercard to connect to their data feed. The API needed to be compliant with the PCI framework – the Payment Card Industry Data Security Standard.

Read the Full Case Study

Max Windheuser - Director, Evinox Energy Ltd

Evinox Energy Ltd – Heating Systems – Saved £140k+

There were several separate projects making up claims for R&D tax relief. One of these was the development of an improved heat interface unit. It was designed to be a combined boiler and tank, with connections to a wider system for heating multiple occupancy accommodation.

In its new design the company sought to improve the efficiency and unit cost of manufacture by introducing a new efficient pump, developing new (and less) control valves, as well as an intuitive ViewSmart Room Controller, that incorporated their own PaySmart pre-payment technology, to allow for centralised reporting and billing.

Read the Full Case Study

Ben Turney - CEO, Teathers

Teathers Financial Software Limited – Fintech Investment App – saved £79k

Teathers research and development work was based around innovative software development (Software as a Service – SaaS) and a new private investor experience concept.

The Teathers App is an execution-only platform. When an AIM-listed company raises money, “onboarded” users of the Teathers App have the opportunity to get involved.

Users are onboarded by downloading the iOS or Android app and completing an account application process. This sets up an execution-only brokerage account with Shard Capital.

Read the Full Case Study

Richard Moore - MD, The Source

The Source – Subterranean Skatepark – saved £26k

The skate park build was very complex and needed a great deal of scientifi c construction research before it could go ahead.

The site dates back to the 1800’s and had been derelict for approximately 18 years. It was originally a swimming pool that also had (and still does have) a full basement of water. The whole footprint of the building is part of a natural stream and water from the roads drain down into the space.

This creates a marine environment. Calculations were required for understanding how timber ramps would expand and contract with the humidity, for example.

Read the Full Case Study

Andy Johnson - Director, Cosmarida Limited

Cosmarida Limited – Cosmetics Manufacturer – Saved £49k

Cosmarida work in an industry where formulation development is an ongoing R&D process. The skincare and toiletries products are constantly being refreshed with new fragrances and

active ingredients.

Despite working to a “brief” from their customer for most product developments, the company were able to qualify for the SME tax relief scheme because the brief was vague. Cosmarida had to experiment with different combinations of fragrances and ingredients to produce a number of samples and make multiple changes to get customer approval. Even then the R&D work isn’t finished.

Scaling up from a small 100ml pot to a 1,000 litre test batch and then a 10,000 litre first production batch, still represent significant challenges. As well as the product manufacturing, the company has also designed and built machines for unique packaging requirements.

Read the Full Case StudyBook a FREE 15 Minute Call

We’ve found that an initial 15-minute phone call is normally sufficient for us to determine whether there is some potential in a project. Choose a date and time to schedule in your free, no obligation call with our experts.

BOOK A FREE CONSULTATION

Does my Business Qualify?

The simplest definition of R&D is when a company looks for an advance in science or technology. This is deliberately broad and it means it can be interpreted to include the development of physical technologies as well as software.

In order to get R&D tax relief for a technology project, you will need to show in your claim that your company looked for an advance, had to overcome an uncertainty, took steps to overcome this uncertainty, and that this work couldn’t have been achieved easily by someone in your industry.

It only takes 15 minutes to find out if you are eligible for R&D Tax Credits – why not book in a call today?

Latest News & Insights

30 September – Massive deadline for R&D Tax Relief Claimants

In the last 2 years there have been some massive changes to R&D Tax Relief. One of them has a looming deadline for around 30% (I’m guessing, but it’s an…

SME v RDEC: What are the differences?

“There is far more that unites us, than divides us” is a phrase that you might often here in politics. It is the same when it comes to claims for…

Are you worried about your R&D Tax Credits Claim?

Since the start of the year, the R&D Tax Credits industry has been shaken to its core by a significant increase in the number of enquiries being opened by HMRC…

Could your SIC Code land you in hot water with HMRC?

Over the last 12 months, there has been significant focus at HMRC on a company’s SIC Code in determining whether they should open an enquiry into a Research and Development…